When working with sales tax

and use tax it is often useful to set the date of a transaction for tax

purposes. For example, assume a February invoice subject to use tax

arrives in March. This is after February has been closed and use tax

submitted. The invoice still needs to be dated in February to age

properly, but it needs to appear on tax reports for March to ensure that

the taxing authority is paid properly. Dynamics GP includes

functionality to support this but it needs to be turned on. Tax Date

functionality was originally designed to support Value Added Tax (VAT),

found in Europe and other parts of the world. Firms with this

requirement will need to activate tax dates as well. In this recipe,

we'll look at how to activate and use tax dates.

Getting ready

Prior to using Tax Dates they need to be activated. To activate Tax Dates:

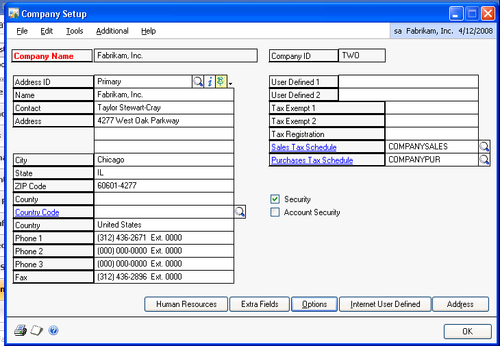

1. Select Administration from the Navigation Pane. On the Administration Area Page, select Company under the Setup and Company headers.

2. Click on Options in the Company Setup window:

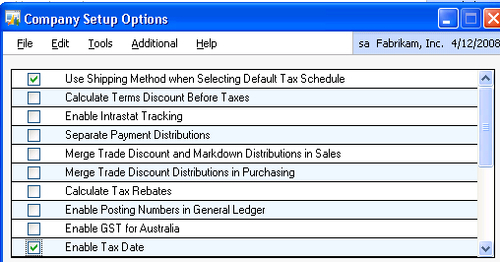

3. Select the checkbox marked Enable Tax Date and click on OK twice:

Tax Date functionality is now set up. Let's look at how to use it in a transaction.

How to do it...

To use Tax Dates in a transaction:

1. Select Purchasing from the Navigation Pane on the left and then select Transaction Entry from the Purchasing Area Page.

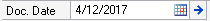

2. This opens the Payables Transaction Entry window. Press Tab to go to the Doc. Date field, select the blue arrow next to the date field, and enter 4/12/2017:

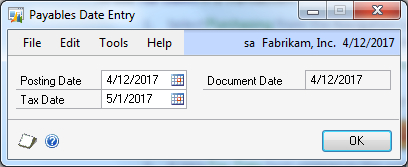

3. A new Tax Date field appears in the Payables Date Entry window. Enter 5/1/2017 in the Tax Date field and click on OK:

How it works...

The Tax Date feature is

required for processing Value Added Tax (VAT) but it's also very useful

for sales tax and use tax reporting. Once the Tax Date feature has been

activated, tax dates on transactions are available to add to the

SmartLists. This makes reporting on tax dates easy and flexible.