Dynamics GP allows an unlimited number of historical and open fiscal years.

Dynamics GP manuals and online help state that

you can only post transactions to two open years. This is not the

case—you can post transactions to any and all open years you have in

Dynamics GP.

The following are guidelines for fiscal years and periods in Dynamics GP:

Each fiscal year can have up to 367 fiscal periods.

Fiscal years cannot overlap.

Each fiscal period within a fiscal year can have a different length.

Fiscal year names can only be a four digit year number.

Up to three periods can have the same starting date.

This is sometimes, although rarely, used for adjustment periods and is

typically not recommended. Best practice is to not have overlapping

fiscal periods.

You can make changes to fiscal periods after they have been set up.

You

can only post transactions to the last historical (closed) fiscal year.

For example, if 2007 and 2008 are closed you can still post to 2008,

but you cannot post to 2007 anymore.

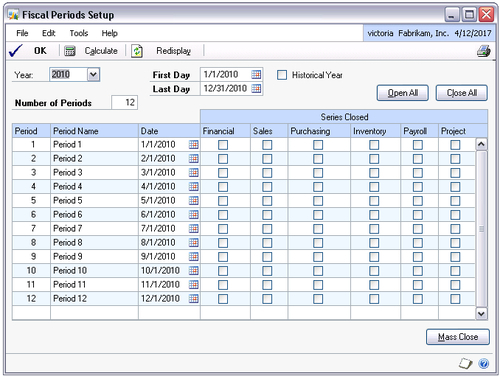

Most companies have fiscal years that are calendar

years and choose to have 12 periods (one for each month), so the fiscal

period setup would look like the following example:

If your company fiscal year is not the calendar

year, most likely the year is referred to by the date it ends. For

example, if the fiscal year is from July 1, 2009 to June 30, 2010, it

will typically be referred to as Fiscal Year 2010. This is more of an

accepted convention and Dynamics GP will not enforce the naming of your

years. If you think that there is a possibility you will want to change

to a calendar year fiscal year sometime in the near future, consider

renaming your years during your Dynamics GP implementation to use the

number of the beginning year, for example:

|

Fiscal Year

|

Start Date

|

End Date

|

|---|

|

2008

|

July 1, 2008

|

June 30, 2009

|

|

2009

|

July 1, 2009

|

June 30, 2010

|

|

2010

|

July 1, 2010

|

June 30, 2011

|

This approach will allow you to seamlessly add a short year whenever you are ready to switch to a calendar year:

|

Fiscal Year

|

Start Date

|

End Date

|

|---|

|

2011

|

July 1, 2011

|

December 31, 2011

|

|

2012

|

January 1, 2012

|

December 31, 2012

|

An alternative to this is to keep the fiscal year

naming you currently have and if the change to a calendar year is made,

purchase a tool from Microsoft called Fiscal Period Modifier (part of

the PSTL), which will allow you to rename your existing years.

When choosing how many years

to set up, consider what you have decided about importing historical

General Ledger balances.