In the United States Tangible

Personal Property Tax is a local tax on non-real property held by

businesses. It is one of the most difficult taxes to account for and

process because each locality uses a different form and a different

calculation. The tax can be assessed at the state, county, or city level

and in some cases, at all three levels with three different forms. The

small firm I worked for had to process 12 different jurisdictions for 6

locations. The number of tax returns can increase exponentially with

each company location.

Dynamics GP at least provides

an option to track tangible personal property locations and costs as

part of Fixed Assets, but the window is not well labeled. Consequently,

most users don't know that this option exists.

This recipe looks at the tangible personal property

tax functions in Dynamics GP and how to use them to make the tax filing

process more efficient.

Getting ready

As tangible personal property tax is based first on

location, the first step is to set up locations that will ultimately be

attached to Fixed Assets. To do this:

1. Select Financial from the Navigation Pane and click on Location under Setup.

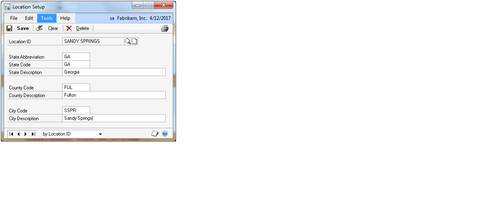

2. The Location Setup window will open. Though it's not marked this way the Location Setup window is designed to hold the key location pieces for tangible personal property tax, state, county, and city.

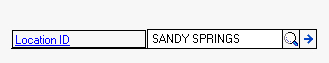

3. For our example, enter SANDY SPRINGS as the Location ID.

4. In the State section enter GA as the State Abbreviation, GA as the State Code, and Georgia as the State Description.

5. In the County section enter FUL as the County Code and Fulton as the County Description.

6. Finally, in the City portion enter SSPR as the City Code and Sandy Springs as the City Description:

7. Click on Save to save the location. This step should be repeated to correspond to each of the firm's locations.

The second and third parts of tangible personal

property tax are category and either cost or value depending on the

jurisdiction's requirements. Consequently, user defined fields are the

best options to hold both the tax category and the previous year's cost

or value. To set up these user defined fields:

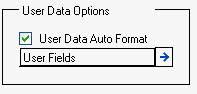

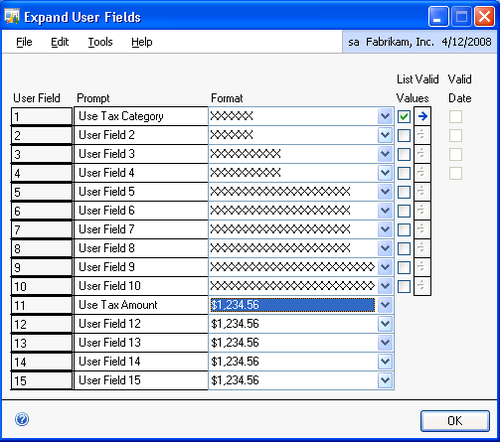

1. Click on Financial on the Navigation Pane and select Company under Fixed Asset Setup. Click on the blue arrow next to User Fields in the User Data Options section:

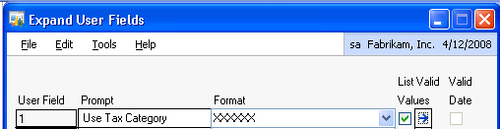

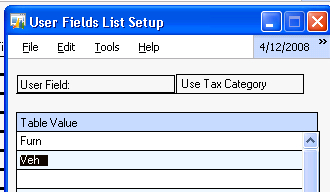

2. This opens the Expand User Fields window. Set the Prompt for User Field 1 to Use Tax Category, select the List Valid Values checkbox, and click on the blue arrow:

3. On the User Fields List Setup window enter Furn and Veh to represent furniture and vehicles, two common categories. Click on OK to close:

4. Back on the Expand User Fields window key Use Tax Amount in the Prompt field for User Field 11. Click on OK and then Save to finish:

As tangible personal property tax is normally based

on location, category, and cost/value the first step is to attach the

right location information to Fixed Assets. To attach a property tax

location to an asset:

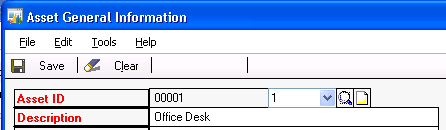

1. Select Financial from the Navigation Pane and then select General under the Fixed Assets header in the Cards section.

2. In the sample company, use the lookup button (indicated by a magnifying glass) to select asset 00001 having suffix 1:

3. In the Location ID field use the lookup button (indicated by a magnifying glass) to change the location to SANDY SPRINGS:

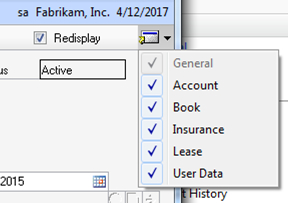

4. Select the GoTo button on the top right of the window and select User Data:

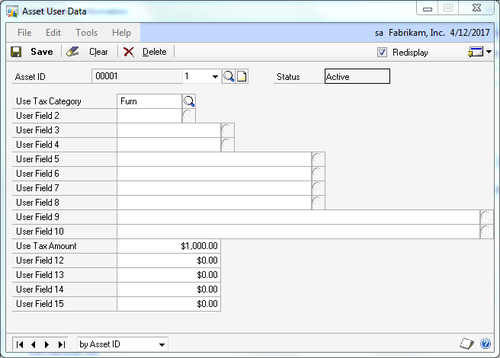

5. Use the lookup button (indicated by a magnifying glass) next to Use Tax Category and set it to Furn. Set the value of Use Tax Amount to $1,000.00:

6. Click on Save twice to save the setup.

7.

Now all of the based information needed for Tangible Personal Property

Tax reporting can be accessed via a Fixed Asset SmartList.

How it works...

Tangible Personal Property Tax is highly local and

non-standardized. Consequently, the best option is to have all of the

data available to at least ease the calculation burden making reporting

more of an administrative function. Using built-in location

functionality allows reporting at any of the taxing entity levels.

The value of user defined

fields for Tangible Personal Property Tax is such that they allow

category reporting separate from other categories used for financial or

federal tax reporting. As tangible personal property tax amounts are

jurisdiction-specific and can be based on actual cost, a declining

percentage of cost, or another value assigned by the organization, the

use of a user defined value field separates this tax value from actual

costs and provides a specific tax basis value.