There are times when

companies need to process sales or use tax transactions through the

general ledger rather than through a subledger such as Sales or

Purchasing. Perhaps tax was incorrectly calculated or omitted on the

original transaction. It's also possible that a company uses another

system to feed the general ledger in Dynamics GP. For example, at one

company I worked for we used a specialized accounts receivable

application that was designed for our industry. Data from that

application was integrated with Dynamics GP and all other transactions

ran through Dynamics GP directly. This can lead to the need to process

tax transactions through the GL.

Dynamics GP includes options to calculate and process

taxes directly through the general ledger and that is the focus of this

recipe.

Getting ready

Prior to processing tax transactions via the general

ledger, this feature needs to be turned on. To activate the ability to

process taxes through the general ledger:

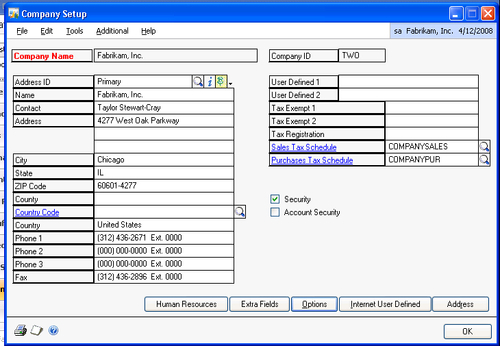

1. Select Administration from the Navigation Pane. On the Administration Area Page select Company under the Setup and Company headings.

2. Click on Options in the Company Setup window:

3. Scroll down in the window and select the checkbox marked Calculate Taxes in General Ledger. Click on OK twice:

Now that tax calculations in the general ledger have

been activated let's see how they work. We'll use the sample company's

tax schedules for our example.

How to do it...

To calculate taxes in the general ledger:

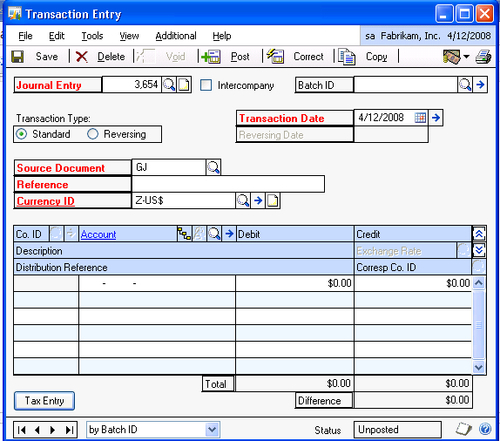

1. Select Financial from the Navigation Pane. Select General under Transactions on the Area Page.

2. Select the new Tax Entry button on the bottom left of the Transaction Entry window:

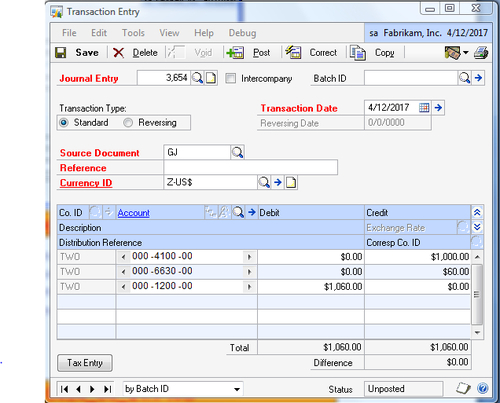

3. On the Tax Entry window set the Transaction Type to Credit. Use the lookup button (indicated by a magnifying glass) to select or key in the sales account 000-4100-00. Enter $1,000.00 in the Sale/Purchase Amount field:

4. Use the lookup button (indicated by a magnifying glass) to select USASTE-PS6N0 (State Sales Tax) in the Tax Detail field. Notice that Dynamics GP will fill in the tax amount automatically. Click on Create to create the transaction in the general ledger:

5. The created transaction will have the account and amount entered

along with the appropriate tax. As this is only one side of the entry,

enter 000-1200-00 (Other Receivables) in the next open line to balance the transaction:

How it works...

The ability to calculate

taxes as part of a general journal entry provides the ability to

accommodate tax adjustments and changes in tax law. It also provides

flexibility to work with other systems connected to Dynamics GP.