In addition to the setup

categories we have discussed so far, there are a few more topics that

are sometimes not looked at until after installation but that you may

want to consider prior to setup.

Shipping Methods

Shipping Methods are company specific

and are used to define all the possible shipping options a company uses

to deliver goods to customers or receive goods from vendors. During the

Dynamics GP installation a default list of shipping methods can be

installed.

The two major functions of

shipping methods are to communicate the shipping information to

employees, customers, and vendors on transactions and documents, and to

determine what taxes are calculated automatically by Dynamics GP. For

example, if the shipping method on a customer invoice has a type of

Delivery, then the customer's shipping address will determine the tax.

If the shipping method has a type of Pickup, then your company's

warehouse location will determine the tax.

Payment Terms

Payment Terms are company specific

and define the terms offered to customers and available from vendors for

payment of invoices. Default payment terms can be loaded during the

Dynamics GP installation and can be changed or added to as needed.

If your company has a large list of available payment

terms, you may want to identify them ahead of time so that they can be

created during the implementation. Payment terms, when set up for

customers and vendors, will default on all transactions and

automatically calculate due dates, making transaction entry faster and

more accurate.

Credit Cards

Credit Cards can be set up in Dynamics GP to be used for payment to vendors and to be accepted as payment from customers.

Credit cards accepted from customers

There are two options for credit cards accepted from customers:

Bank Card / Checkbook ID: This will associate a credit card with a bank account (also called Checkbook)

in Dynamics GP. When a customer payment is entered using this type of

credit card, the payment amount will automatically go to the bank

account specified. This setup option is typically used when the full

amount of the credit card charge is deposited into the company's bank

account by the credit card processor, and the credit card processing

fees are taken out separately on a monthly basis.

Charge Card / Account Number: This

will link the credit card to a General Ledger account. When a customer

payment is entered using this type of credit card, the payment amount

will be posted as a debit to the GL account specified, and will require a

separate entry to move the payment out of this GL account into the cash

account. This type of credit card setup is useful when the credit card

processor takes their discount or fees out of every transaction. For

example, a customer pays $500 with a credit card, but only $487.50 is

deposited into the bank account with a $12.50 fee deducted right away.

Credit cards used to pay vendors

There are also two options for setting up credit cards used to pay vendors:

Credit Card / Vendor ID: This will associate a

credit card with a vendor in Dynamics GP. When a vendor payment is

entered using this type of credit card, the payment amount will

automatically create an invoice payable to the credit card Vendor ID

specified. This setup option should be used for traditional

credit card accounts that send a monthly statement to be paid

separately.

Check

Card / Checkbook ID: This option will link the credit card to a bank

account (Checkbook) in Dynamics GP. When a vendor payment is entered

using this type of credit card, the amount will be posted as a cash

withdrawal from the Checkbook specified. This credit card setup is used

for what is commonly called Debit Cards, where each purchase is deducted

from the bank account right away.

Credit card setup is company specific in Dynamics GP. Multiple companies cannot share credit cards.

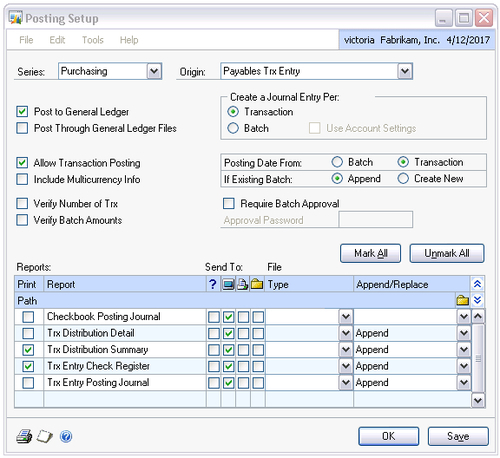

Posting setup

Each type of transaction posted in Dynamics GP can be

set up to behave differently. Posting settings are company specific, so

the same type of transaction can have different settings in each

Dynamics GP company. All of the posting settings can be changed at any

time, but there are a few important settings that may require additional

discussion or planning ahead of time: Post Through General Ledger

Files, Create a Journal Entry Per, Posting Date From, and Require Batch

Approval.

The following is an example of what the posting settings may look like for transactions originating on the Payables Transaction Entry window in Dynamics GP:

Post Through General Ledger Files

With very few exceptions, all transactions in every subledger will be set to Post to General Ledger. This will create GL entries after the subledger posting is completed. Choosing the Post Through General Ledger Files

setting will automatically post the resulting GL entries at the time of

the subledger posting. If this setting is not chosen, a user will need

to post the GL entries that have been created from subledger postings as

a separate step.

Many companies, when first starting to use Dynamics

GP, decide not to have transactions automatically posted through to the

GL. This gives them the chance to examine the General Ledger entries

created and make sure they understand how the system is behaving with

regard to dates and account numbers defaulted. However, as it takes less

time and work to have transactions automatically posted through to the

GL, eventually many transaction types are changed to use the Post Through General Ledger Files option.

Create a Journal Entry Per

When posting a subledger batch with multiple transactions, the Create a Journal Entry Per

setting determines whether a General Ledger entry is created for each

individual subledger transaction, or whether one GL entry is created

summarizing the entire subledger batch.

Choosing to create one GL entry per subledger Transaction

allows for greater drill-back capability. When looking at a particular

General Ledger entry it is possible to drill back down to the

originating transaction in the subledger. The benefit of choosing to

create one GL entry per subledger Batch is that the GL does not get as cluttered up with individual transactions.

Consider a company that has 500 sales invoices a day.

If each of these creates a GL entry, in a 260 workday year, that will

result in 130,000 GL entries, just from the sales invoices. Many sales

invoices will have numerous GL distributions, so with an average of 8 GL

distributions per invoice, that will become 1,040,000 lines in the GL

per year from sales invoices alone. Typically this much detail is not

needed, as no one will be looking through it at this detail level. In

this scenario, if those 500 invoices are split into five batches per

day, then only five GL entries are created each day, resulting in 1,300

GL entries per year for sales invoices.

To determine the right approach, consider the volume

expected for each type of transaction. If there is any question, the

recommendation is to err on the side of having more detail and creating a

GL entry per transaction. It is much easier to summarize detailed data

with reports than to recreate detail not kept from summaries. This

setting can always be changed in the future as transaction volume

increases.

Posting Date From

Every subledger transaction in Dynamics GP will have

two dates: a subledger date and a General Ledger date. The subledger

date is typically the actual date on an invoice received from a vendor

or sent to a customer. The General Ledger date is the date a transaction

will show up on financial statements.

Dynamics GP easily allows these two dates to be

different and keeps track of all the dates throughout the accounting

process. Reports that are printed will usually have an option for

selecting transactions using the subledger date (also referred to as

Document Date) or the GL date (also referred to as the Posting Date or

GL Posting Date). For example, a company may need to print two different

Receivables Historical Aged Trial Balance reports: one using the

subledger dates, which are actual invoice dates, to see the true aging

of customer accounts, and another using the GL dates to reconcile the

Receivables subledger to the General Ledger.

The two choices for the Posting Date From setting are Batch and Transaction. Choosing Batch means that all transactions entered in the same batch will be posted with the same GL date, set at the batch level. Choosing Transaction will allow each transaction within a batch to have its own GL date. If Create a Journal Entry per Batch is selected, this option will be grayed out and automatically set to Batch.

As dates are critical to keeping accounting records

accurate, this setting should be considered carefully and may need to be

different for different types of transactions, depending on how they

are entered or imported into Dynamics GP. The more commonly seen

recommendation is to set the Posting Date From option to Transaction to allow for greater control during transaction entry.

Require Batch Approval

For certain types of transactions it may be helpful

to prevent users from posting their transaction batches until someone

else has reviewed and approved them. In many companies this is

accomplished with training and there is no need to have Dynamics GP

enforce this behavior. However, if desired, the Require Batch Approval setting in Dynamics GP will ensure that a batch cannot be posted without an Approval Password.

Multicurrency

If you have decided to use the Multicurrency module, currencies and exchange rate tables should be planned out.

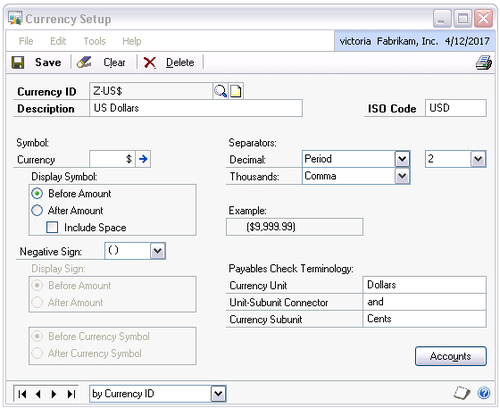

Currencies

Determine all the currencies that will be used and

what the ID for each currency should be. Additional considerations for

currencies are the symbols to use, the number of decimal places to keep,

what separators to use for decimals and thousands, and what company in

Dynamics GP will have access to each currency. The following is an

example of a typical Currency Setup window:

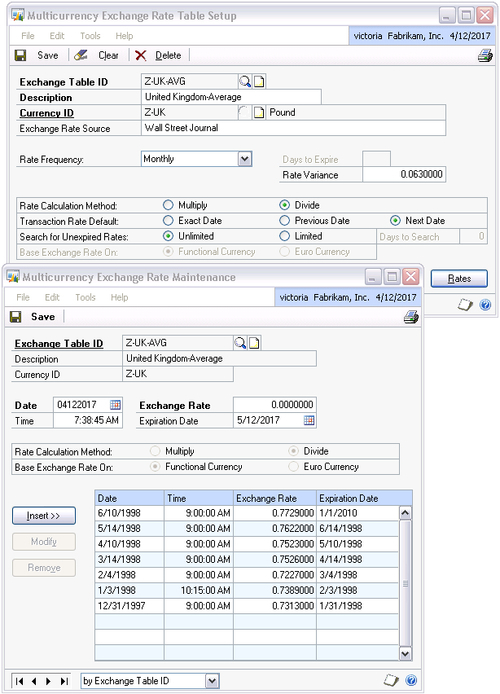

Exchange Rate Tables

If using Multicurrency, decide what the source for

your exchange rates will be and whether to use one or more rate type.

Dynamics GP allows for SELL, BUY, and AVERAGE rates, however there is no

requirement to use all of them. Many companies use only a single

AVERAGE rate. Another decision is how often the exchange rate table

should be updated. The following is an example of the Multicurrency Exchange Rate Table Setup and Multicurrency Exchange Rate Maintenance windows: