Use Tax is a form of self-reported sales tax.

Companies in the United States who purchase items not intended for

resale are typically required to pay sales tax. If they are not charged

sales tax at the time of purchase they are required to report and remit

use tax on these items.

Dynamics GP is well equipped to deal with sales tax

but use tax presents more of a challenge. Essentially, use tax needs to

be applied to an accounts payable transaction but the payment of use tax

is sent to a taxing authority, not to the transaction vendor. A common

way to accomplish this in Dynamics GP is to use the built-in credit card

functionality to shift the use tax liability from the vendor to the

taxing authority.

In this recipe, we'll use the sample company and look at hacking credit card functionality to enter and track use tax.

Getting ready

Before we start we need to set up a use tax detail and a credit card for a taxing authority. To set up a use tax detail:

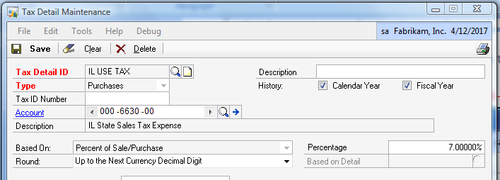

1. Select Administration from the Navigation Pane. Select Tax Details from the Area Page under Setup | Company.

2. Type IL USE TAX in the Tax Detail ID field and set Type to Purchases.

3. Set the Account field to 000-6630-00 and the Percentage to 7%. Click on Save to continue:

Part two of the setup is creating a credit card to

"pay" the use tax amount and transfer the liability for payment from the

vendor to the taxing authority. To set up a use tax credit card:

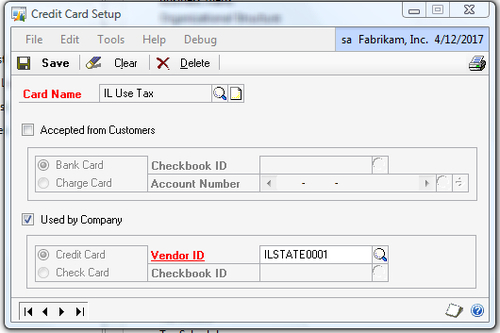

1. Select Administration from the Navigation Pane. Select Credit Cards from the Area Page under Setup | Company.

2. Name the credit card IL Use Tax and select the Used by Company checkbox.

3. Click on Credit Card and set the Vendor ID to ILSTATE0001:

4. Click on Save to finish the setup.

How to do it...

Now that we've completed the use tax setup let's see how to apply use tax to a transaction:

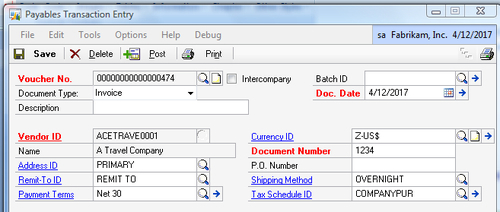

1. Select Purchasing from the Navigation Pane. Select Transaction Entry from the Area Page under Transactions.

2. Use the lookup button (indicated by a magnifying glass) next to Vendor ID to select ACETRAVE0001.

3. Press Tab to move to the Document Number field and type 1234:

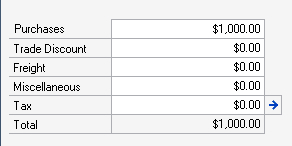

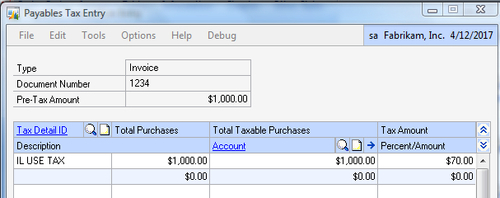

4. Move to the Purchases field and enter $1,000.00. Press Tab to move to the Tax field and click on the blue arrow next to it to open the Payables Tax Entry window:

5. In the Payables Tax Entry window use the lookup button (indicated by a magnifying glass) to select the tax detail IL USE TAX replacing the existing tax detail named USEXMT+PSONO that defaults from the vendor. Click on OK to return to the payables transaction:

6.

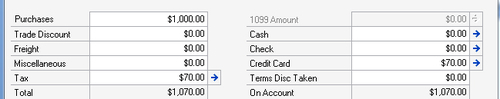

Now that tax has been applied to the transaction, if we leave it like

this, the vendor will get paid $1,070. That won't work since we actually

owe the vendor $1,000 and we owe the Illinois taxing authority $70. To

fix this, press Tab to move to the Credit Card field and enter $70.00:

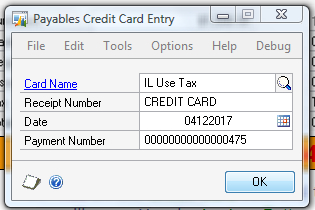

7. Press Tab to move off the Credit Card field and the Payables Credit Card Entry window will open. Use the lookup button (indicated by a magnifying glass) to select IL Use Tax as the Card Name. Click on OK to continue:

Notice that the On Account field is now $1,000.

This is the amount due to the vendor. When this transaction is posted

two AP vouchers will actually be created, one to Ace Travel for $1,000

and one to the Illinois taxing authority for $70. At month end when a

check is generated to the Illinois taxing authority, each use tax

voucher is included in the check, providing an effective audit trail for

use tax transactions.

How it works...

Combining sales tax and credit card functionality to

solve a use tax need is a perfect example of a useful hack. The vendor

ends up being paid the right amount and so does the taxing authority. In

addition, the expense side of the tax doesn't have to go to a tax

expense account. The account can be changed to apply to the same account

as the purchase to reflect the true cost of the transaction.

Because this is a hack it's not perfect. Payments to

the vendor are overstated by the tax amount because the tax wasn't

actually paid to the vendor. This could result in an incorrect 1099 for

vendors due one at tax time. The 1099 amounts can be adjusted on each

transaction, but this is often missed. Generally though, these issues

are minor compared to benefits of applying use tax to transactions.